How to Buy Mutual Fund and UITF Shares in BPI Express Online

In order to be able to use this facility, please take note of the following requirements before proceeding:

- User must have an enrolled BPI Express Online Account

- User must have an enrolled Investment Account with BPI Express Online

Note: If you followed the second option in the first step, and went directly to your Investment Account section, you will be able to skip this step.

3. Next window is your Portfolio Composition. Given the investment account that you've chosen, the site will show you which Mutual Funds or UITFs you own. Just click the "Continue" button at the bottom of the page to proceed. In this page, you can also click on "Risk Profile" to review or change your risk profile.

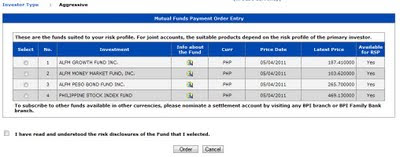

4. The next window will be the Mutual Fund or UITF selection page. Here you get to select which mutual fund or UITF you want to buy.

On the top left portion of the page is your risk profile. It is indicated by the label "Investor Type." How is this significant? As a standard procedure, only Mutual Funds or UITFs with an equal or lesser risk rating than your risk profile will be available for selection to the investor. So if you don't see the Mutual Fund that you like, it's probably because the risk rating of that fund is higher than your risk profile. To solve this problem, you'll have to review and change your "Risk Profile" in the previous step.

There is a reason why the system was built this way. It's to prevent investors with low risk appetites from investing in high risk funds. Please be cautious when doing this and make sure you know what you're getting into. Highest Investor type one can get is "Aggressive."

Select the name of the fund you want to subscribe to by clicking on the round button beside the name of the fund. Click on the check box affirming that you have read the risk disclosures of the fund that you selected. And then click the "Order" button to proceed.

Please refer to the image below to see the risk ratings of the different BPI UITFs and Mutual Funds.

5. The next window is the Payment Order form. In this form, you indicate your desired subscription amount. Note that the amount must not be less than the Minimum Additional Subscription required by the fund. For BPI UITFs, the minimum additional subscription is normally at Php 1,000 for Peso-based funds and USD 200 for Dollar-based funds. For ALFM Mutual Funds, the minimum additional subscription is normally at Php 10,000 for Peso-based funds and USD 200 for Dollar-based funds. To be sure, check the BPI Asset Management page. Click the "Continue" button to proceed.

Note that your settlement account must be properly funded at this time in order for the transaction to be accepted.

6. Next is the Confirmation page. Check the details of your placement and make sure that it's correct. Click on the check box to agree to the stipulations written in the site. Input your BPI Express Online password on the space provided and click "Proceed" to finalize your transaction.

At this point, your settlement account will be earmarked with your subscription amount. BPI will already deduct your subscription amount from your account. Since the price of the fund will not be available until the end of that banking day, you will not know the total no. of shares or units you bought and the total subscription amount until the next day. Any excess in your subscription amount will be credited back to your account the next banking day. BPI will not go over the subscription amount that you indicated.

7. Finally, the site will give you the transaction's Confirmation number as shown below. BPI Express Online will also email your designated email account of the details. This is to confirm that your Mutual fund or UITF subscription been accepted and is already queued for processing.

With this facility from BPI, investing in Mutual Funds and Unit Investment Trust Funds is now more convenient and accessible especially for those of us based outside the Philippines. It is also a great facility for traders and investors who would want to time their entry and exit in such funds. Let's hope that other banks and Investment companies will soon follow suit and take investing another level here in the Philippines. (We heard that First Metro Asset Management is already working on their online facility as well *fingers-crossed*).

5 comments:

-

Hello, thanks for exerting effort to publish this comprehensive step by step guide on how to purchase such. I think I still need to enroll with the BPI account. MOre power to your blog. I'm sure your readers will be glad to have these information.

-

Hi Vic!

Thanks.

-

This was a definitely very superior post. In theory I’d prefer to publish like this also - getting time and actual effort to make a fantastic piece of writing… but what can I say… I procrastinate alot and by no means seem to obtain one thing done.

Financial Planning

-

My dilemma was answered by this post. Great one! I did make my initial subscription of 10,000 pesos for PSIF and was able to bought 16 shares. On my portfolio, the total market value was showing only 9,492.96. I was thinking, what happened to the 500 plus! Ganun ba kalaki yung charges. Eh ang alam ko wala naman. So yun pala, ibabalik nila yung excess the following day. Thanks ng marami! More power!

-

Hi!

I'm glad it was of help to you Anonymous. Thanks for leaving a comment.

Napaka-encouraging malaman na merong mga tanong na nasasagot ng blog na ito.

Keep of Attracting wealth!